What is Venmo?

Venmo is a mobile payment service that facilitates peer-to-peer money transfers and payments. Having started out as a text-message payment system in 2009, Venmo evolved into a digital payment platform and launched a smartphone payment app in 2012. Since 2013, it’s been owned by the fintech giant PayPal.

How does Venmo work?

As a peer-to-peer networking app designed for quick and easy financial transactions, payments between Venmo accounts transfer funds between digital wallets hosted on the platform. This is how Venmo works to enable instantaneous in-app money transfers — a big advantage over traditional bank-to-bank transfers, which can take hours or even days to process.

While mostly intended for transfers between friends, family, and other contacts, you can also use Venmo to make digital payments to authorized merchants. But there is a Venmo transaction fee for commercial payments. And if you make Venmo transfers using a credit card (rather than a debit card, or your existing Venmo account cash balance), a 3% surcharge is applied.

Venmo security: Is Venmo safe?

Generally speaking, Venmo is secure and safe to use thanks to bank-grade encryption safeguarding your account information and financial transactions. The security of Venmo payments is strengthened by features that restrict payments to personal contacts, along with a 24/7 customer service helpline offering support in the case of suspected fraud.

Venmo also allows people to add an extra level of security to their account by enabling two-factor authentication (a type of multi-factor authentication) and a PIN (personal identification number). But, like other accounts, Venmo wallets are still potentially vulnerable to hacking and password cracking.

Venmo offers multi-factor authentication for greater security.

And despite Venmo’s security protocols, there are still payment verification loopholes that scammers, fraudsters, and other crooks can take advantage of, so it’s not safe to make payments on Venmo to people you don’t know and trust.

What are the risks of using Venmo?

Although it’s considered a safe payment platform, Venmo privacy concerns have emerged around the ease of finding other Venmo users — even Joe Biden’s Venmo account was discoverable. Also, the platform’s default privacy setting is “public,” meaning users’ profiles, including their transaction histories, are visible.

Other Venmo security risks include:

- Potential password vulnerabilities

- Losing your phone while logged into your account

- Making transactions with unknown, potentially fraudulent accounts

- Getting tricked by a Venmo phishing scam

- Exposing your social and financial connections

To mitigate these Venmo risks, protect your account by creating a strong password, and changing your privacy settings to hide past transactions and keep future payments secure and private.

Does Venmo have buyer protection?

Although Venmo doesn’t offer comprehensive buyer protection, it does have a Purchase Protection Program for commercial transactions that meet certain criteria. Qualified payments include:

- Purchases made using a Venmo Debit Card

- Purchases from specific, authorized merchants

- Payments to business or personal profiles that are tagged as a “purchase” and sent using the Pay and Request feature in the Venmo app

If items you paid for through Venmo aren’t delivered at all, arrive damaged, or are simply incorrect — and you qualify for Venmo fraud protection under the above terms — you’ll be reimbursed for the purchase, plus shipping costs.

But while Venmo does offer fraud protection under those limited circumstances, money sent via the app is not protected in most situations. That means a lot of loopholes remain open to abuse, leaving users vulnerable to Venmo scams.

Common Venmo scams to look out for

Venmo scams usually take advantage of social engineering techniques to lure people in with fake news, spam emails, or Venmo scam texts. The best way to avoid Venmo scams is to use Venmo only with trustworthy people you know.

So, is there a Venmo scam you need to watch out for, in particular? Unfortunately, there’s a whole bunch of them. Here are the most common Venmo scams to watch out for:

- Fake listing scams

This scam revolves around bogus rental listings or job ads. They may seem legitimate at first, but after requesting money upfront before signing a contract, the scammers cease all communications and make off with your cash. - Fake screenshot scams

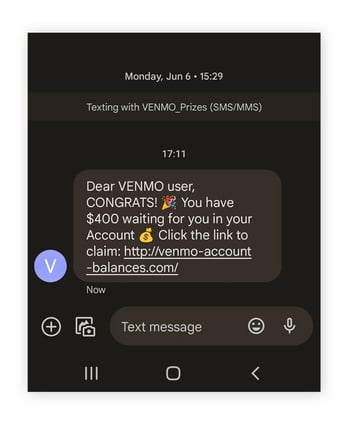

Scammers may try to hoodwink you by mocking up a fake screenshot appearing as if they’ve sent money to your account. That’s why you should always verify incoming payments to your Venmo account within the Venmo app itself. - Fake prize reward

Some Venmo scammers send text messages or emails claiming you’ve won a cash prize or reward that can be redeemed through Venmo. Don’t click the link (it could contain a virus) and don’t reply with your account details. If something seems too good to be true, it probably is.

- Venmo email scams

If you get a suspiciously urgent email supposedly from Venmo, it’s likely a Venmo email scam designed to compromise your account and steal money from your digital wallet. Do not click any links or reply to the email. If in doubt, contact Venmo customer support directly, and they’ll be able to verify whether it’s an authentic email. - Venmo text scams

Similar to Venmo email scams, Venmo text scams appear as normal SMS messages from Venmo or a trusted business or person. Don’t click any links or reply with your Venmo account details. Simply block spam texts to stop them from bothering you again. - Romance scams

A person you meet online may ask you to send them money on Venmo for a flight ticket to visit you, or to support them financially, only to make further demands or ghost you entirely. The best way to avoid this Venmo scam is to not send money to people you don’t know and trust. - Pre-payment scams

Using fake screenshots as evidence that an item has been shipped is a common Venmo scam. The fraudster will then request money for the item and may ask you not to mark the payment as a purchase, thereby voiding Venmo fraud protection policies you may otherwise qualify for.

How to prevent Venmo scams

Despite the prevalence of Venmo scams, Venmo is safe to use as long as you take precautions to protect your money and account information. Here are healthy user habits and the basics of safer online shopping that will prevent you from being scammed on Venmo:

- Use strong and unique passwords for all your accounts.

- Use multi-factor authentication.

- Use a unique PIN not associated with any other card or service.

- Avoid transactions with strangers or people you don’t trust.

- Don’t leave a large amount of money in your Venmo account.

- Stay vigilant for scammers and follow up if something feels wrong.

- Monitor your credit card and other accounts.

- Use text and email alerts to notify you of Venmo transactions.

- Set your profile to “private”’ to hide your transaction history.

- Monitor devices attached to your account.

- Avoid sharing your login information with anyone, even family or friends.

- Help secure your devices and accounts with one of the best free antivirus software packages.

A good antivirus will scan for threats.

What to do when scammed on Venmo

If you’ve been scammed on Venmo, you should report the Venmo scam just as you’d report other internet scams. As well as helping to fix Venmo security issues, the following steps will help Venmo and other relevant authorities take action against the scammer:

- Report the scam to Venmo’s customer security support immediately.

- Update your Venmo password and the passwords of any other compromised accounts.

- Contact your bank to report the fraudulent activity.

- Report the fraud to the Federal Trade Commission (FTC) or your local equivalent.

- Protect your device with a security app to prevent additional scams or attacks.

Venmo alternatives

Here are some reliable alternatives to Venmo for peer-to-peer online payments, and how they work:

- PayPal

Once you sign up for a PayPal account, you can transfer money globally or locally to another PayPal user just by entering their name, username, email, or mobile number, then choosing your payment type. PayPal is considered one of the safest online payment platforms. - Zelle

Available in the US, Zelle is packaged into many banking apps, and you can also download the Zelle app directly. Once you’ve registered with Zelle, enter the recipient’s email address or mobile number and choose how much to send. - Cash App

Available in the US and UK, you need to download the mobile app and set up an account. Then, you can transfer money or cryptocurrency like Bitcoin to another account via the user’s mobile number, email, or $cashtag (username).

Browse securely and privately online

Conducting financial transactions online is never completely without risk. The best way to protect against theft, fraud, and privacy breaches is to be smart about how you access the internet, particularly when dealing with money transfers.

With an array of privacy tools — including an integrated VPN, powerful anti-tracking technology, and ad-blockers that can stop scam pop-ups — AVG Secure Browser helps you protect your financial data and keep all your browsing activity private. Get AVG Secure Browser today — completely free.